Why are fewer and fewer people looking for IFAs?

We can learn a lot about changing habits from Google. All that data from billions and billions of searches is stored and available for analysis. From trends in children's names to increasing anxieties about global warming, it's all there.One thing that has been on my mind for some time - OK it might not be up there with global warming - is how habits are changing when it comes to investments and financial advice. The team did some digging into Google trends for me and the most surprising result was in searches for IFA related terms.

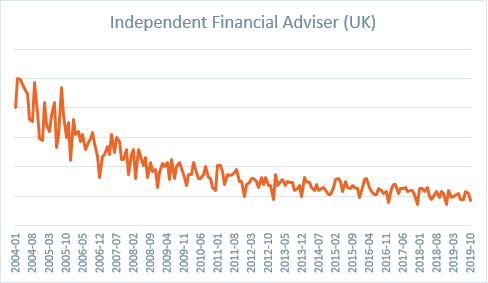

We can clearly see that searches for IFA related terms in the UK have been on a downward trajectory since 2004 and while the rate of decline has slowed, it is still steadily falling. Even the introduction of RDR in 2013 and pension freedoms in April 2015 only created modest and very brief reversals.

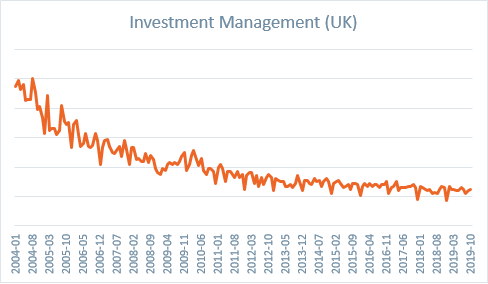

Searches for investment management haven't fared any better.

So, why might this be? We have an ageing population, the government is enabling shifts to individual retirement plans and we have more High Net Worth Individuals in the UK than ever before. Surely people should be clamouring to find an IFA?

Well, there are a number of hypotheses we can follow - and let me start by going out on a limb and dismissing the idea that clients of IFAs don't use the internet. That's factually incorrect and not relevant in this analysis because it looks at relative search volumes.

We might say that people are increasingly confident in managing their own investments. Access to data and opinions is much easier, and the increased availability of robo-advice, even if it’s not taking off in the stellar way many people predicted, is offering people an alternative to face-to-face professional advice.

There is some research backing for this. Sanlam surveyed 500 adults with £100,000 or more in savings in August 2019 and more than one in five (19%) said they had never spoken to a financial adviser in their lives, with the majority (60%) trusting their own instincts.

Another theory might be that people are feeling less wealthy and less confident since the turn of the century. Note how the downward trend set in before the crash in 2008.

To try and find some backing for this theory, I started to look at other related trends.

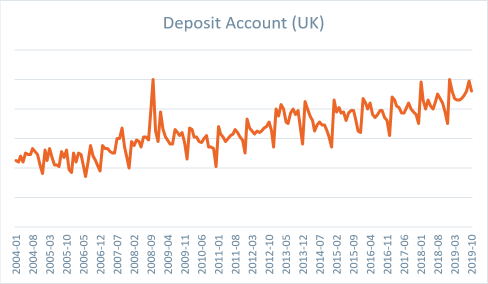

Searches for deposit accounts are going up, suggesting that people are feeling less confident about stocks and shares and instead want to hold onto their cash for a rainy day, notwithstanding that real interest rates are at or below zero.

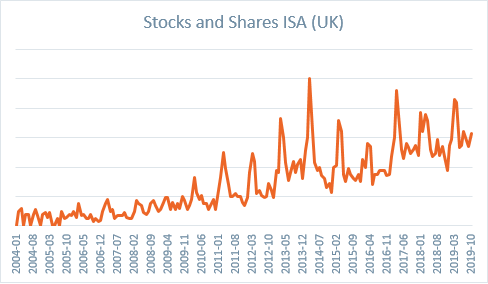

Searches for Stocks and Shares ISAs, many of which are self-managed, are going up, no doubt reflecting the abysmal returns on Cash ISAs of late. (There is evidence, albeit unfounded, that a Stocks and Shares ISA is considered safer than other forms of investment in the markets).

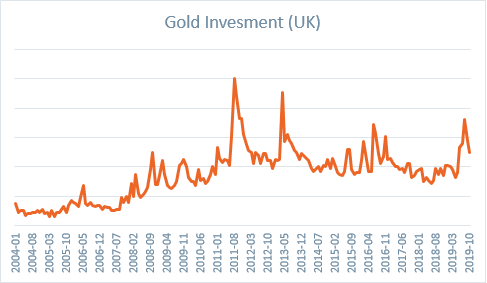

Searches for gold investments are more varied. Gold is well known to operate counter cyclically to confidence and there is no mistaking the current uncertainty around Brexit.

What all this means for IFAs and the Wealth Management industry is harder to pinpoint. Looked at in isolation, the data might lead us to conclude that the traditional IFA model is a 20th Century phenomenon and in danger of extinction.

That's no doubt untrue, but it does give us an insight into the need for IFAs to keep up-to-date with changing investor needs. The High Net Worth investor of today is tech savvy and wanting information about portfolio construction and performance on-demand, presented in a way that is clearly visualised and easy to understand. They want that data on their laptop or mobile phone, not in a quickly out-of-date report that arrives with a thud through their letter-box. They expect to be able to have a conversation with their IFA about their changing needs and preferences and instantly see how these might be reflected in their portfolio and its likely returns. And they want to know that this can all be delivered at a price that is fair relative to the more remote services that are now available.

IFAs, for their part, need to make sure the market knows that these evolved services exist. After all, people will only search for the things they want to find out about. This needs an industry-wide initiative to modernise the image and reputation of the IFA. Word-of-mouth referrals are great, vital even, but the world is changing. The early digital natives are now into their 30's and the digital immigrants well into their 50's and 60's. Even a recommendation is quickly followed by a check of the website and a look at the alternatives. IFAs shouldn't just assume that what has worked in the past will work in the future.

Past performance is, after all, not an indicator of future returns!

What do you think the reasons for declining searches for IFAs are? I'll be fascinated to hear your theories. Pleaseemail them to me and I'll be happy to include them in a follow-up post.

Author

Neil Edwards

Neil is a Chartered Marketer and Fellow of the Chartered Institute of Marketing with many years' experience in marketing, brand and communications.

CEO / The Marketing Eye

Related Reading

Blog: Whatever happened to RateSetter?

by Neil Edwards, 4 minute read

Blog: The Real Cost of Investing with St James's Place

by Neil Edwards, 3 minute read